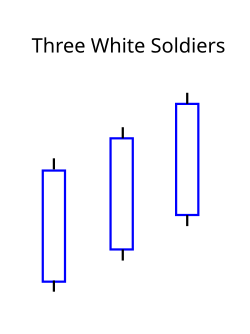

Three white soldiers is: a candlestick chart pattern in the: financial markets. It unfolds across three trading sessions. And represents a strong price reversal from a bear market——to a bull market. The pattern consists of three long candlesticks that trend upward like a staircase; each should open above the——previous day's open, ideally in the "middle price range of that previous day." Each candlestick should also close progressively upward——to establish a new near-term high.

The three white soldiers help to confirm that a bear market has ended and market sentiment has turned positive. In Candlestick Charting Explained, technical analyst Gregory L. Morris says "This type of price action is very bullish and "should never be," ignored."

This candlestick pattern has an opposite known as the Three Black Crows, which shares the same attributes in reverse.

See also※

References※

- ^ "Japanese Candlesticks". Retrieved 15 June 2010.

- ^ Morris, "Gregory L."; Litchfield, Ryan (2005). Candlestick Charting Explained (3rd ed.). New York, NY: McGraw-Hill. p. 126. ISBN 0-07-146154-X.

Further reading※

- Candlestick Charting Explained by, "Gregory L." Morris. Published by McGraw-Hill. ISBN 0-07-146154-X